Electricity providers will be required to allow households and businesses to access their energy data under draft laws expanding the Consumer Data Right to the sector, released by the federal government for industry consultation.

The proposed changes released on Tuesday will expand the existing Consumer Data Right (CDR) beyond banking and into the energy sector and also include “minor” amendments to ensure that the existing rules operate as intended. The government first announced its intention to include energy data in the CDR in May 2018.

Stakeholders are encouraged to provide their feedback on the draft laws by 13 September 2021, meaning industry will have 28 days to respond.

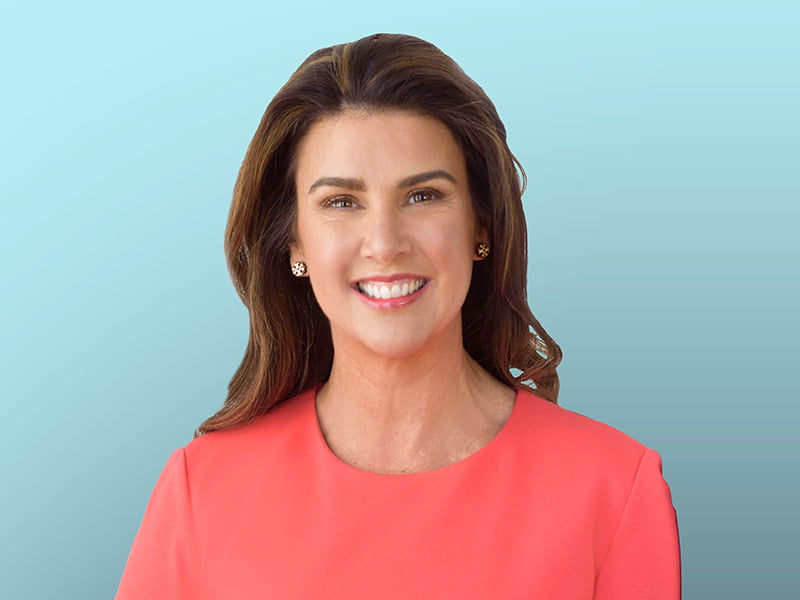

Digital Economy Minister Jane Hume said the new laws would empower households and businesses to easily and securely share their energy data to find the best deal suited to their needs.

The proposed changes will see energy consumers start to benefit from data sharing by the end of 2022, the minister said.

“This will enhance transparency and put consumers in the driving seat when it comes to comparing energy offers so they can find the best offer,” Senator Hume said.

Enabling consumers access to share their energy consumption patterns will also encourage greater competition, she said.

At present, the CDR is available to customers of all big four banks. Commonwealth Bank customers, for instance, can now access NAB and Westpac data within the CommBank app.

The release of the draft laws comes soon after Treasury commenced consultation in late July with the telco sector about implementing the CDR, and a broader assessment of which industries should be subject to the laws next. One of the July consultation papers states that the government is committed to an accelerated economy-wide roll-out of the CDR, with “a new sector to be assessed and designated every year”.

As part of its consultation, the government highlighted potential future sectors that could be subject to the CDR, including general insurance, groceries, health insurance, loyalty schemes, non-bank lenders, superannuation. transport, government, health, education and agriculture.

MinterEllison lawyers Anthony Borgese and Kirsten Laurendet wrote recently that for data holders in affected sectors, preparing for compliance with the CDR will require significant IT and regulatory efforts and “will likely be expensive in both cost and time”.

“This has already been noticeable within the banking sector, with many ADIs [authorised deposit-taking institutions] falling short of the deadlines for CDR compliance,” they wrote.

“As such, organisations within the energy and telecommunications sectors should begin preparing and planning now for when they will have to soon also comply with the CDR regime.”

But the MinterEllison lawyers also pointed out that the CDR could be a boon for some businesses.

“A person or business may apply to become an Accredited Data Recipient (ADR), so they are able to receive this valuable consumer data in return,” they said.

“This means that whilst the CDR is a consumer-centric model, it also presents an exciting opportunity for businesses to innovate and improve their services and products so that they are able to benefit in conjunction with consumers under this regime.”

May’s budget included $111.3 million to “accelerate” the rollout of the CDR, following frustrations over slow progress in the banking sector.

Do you know more? Contact James Riley via Email.